The cash book in accounting is a record of all the money that flows in and out of the business bank account. It is one of the books of prime entry in accounting, used to record information from source records (bank statements in this case) to summarise information that is transferred to the general ledger to prepare the trial balance and, ultimately, the financial statements.

What Information is Included in the Cash Book in Accounting?

The cash book is a record of all the payments and receipts that come in and out of the business bank account, whether that is in the form of:

- Bank transfers

- Standing orders

- Direct debits

- Cash deposits

For each entry, the following information is included:

- The date the transaction took place in the business (which may not be the same date as it appears on the bank statement)

- Who made/received the payment

- A description of the transactions

- The value of the transactions (including sales tax)

What Does Not Appear in the Cash Book?

Only items that appear on the bank statement will appear in the cash book, therefore petty cash will not appear and instead will be recorded in the petty cash book.

What Does a Cash Book Look Like?

In double-entry bookkeeping, the cash book takes the form of t-account with debits (money received) on the left and credits (money paid) on the right.

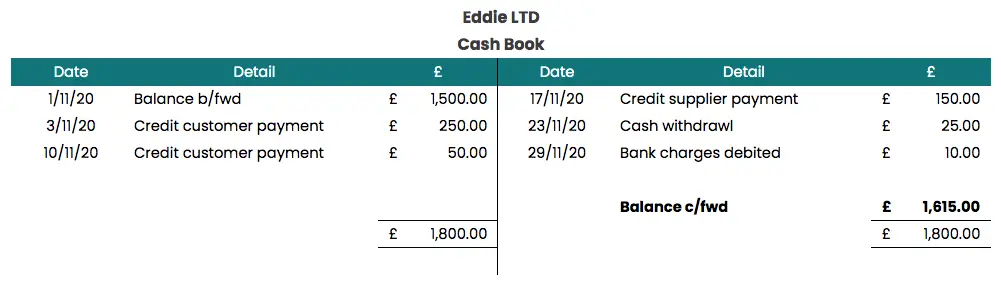

Example of Writing Up a Cash Book

Eddie LTD has an opening balance on their cash book of £1,500 as at 1 November 2020. During November the following receipts and payments happened:

- Credit customer paid £250 on 3 November 2020

- Credit customer paid £50 on 10 November 2020

- Payment to credit supplier £150 on 17 November 2020

- Cash is withdrawn of £25 on 23 November 2020

- Bank charges debited £10 on 29 November 2020

The balancing figure c/fwd is £1,615, which is the balance in the bank account at the end of November after all the transactions have taken place.

The Cash Book T Account

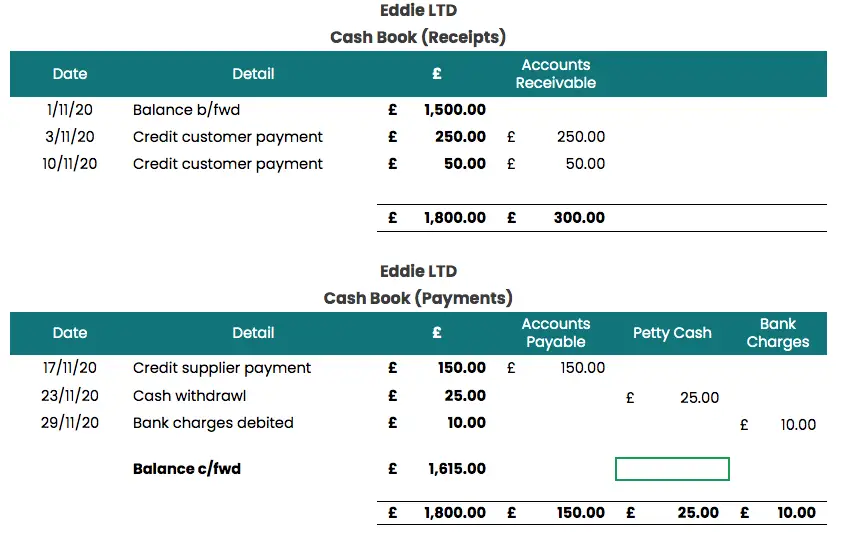

Although the cash book is a t account, in reality business sometimes want to analyse their cash book in more detail to help them analyse the numbers and make journal entries to the general ledger easier.

That means the t account may be split to allow more columns. In our example above, the cash book could look like this instead:

Cash Book Reconciliation

Periodically, the cash book must be checked against the bank statements to make sure that the cash book is correct. It is important because if there are errors in the cash book the numbers transferred to the general ledger and books of prime entry like the sales day book, will be wrong and the financial statements will be incorrect. This cross-check is known as a bank reconciliation.