The general ledger in accounting is also referred to as the ‘nominal ledger’, or in computerised accounting the ‘chart of accounts’. Whichever name used, it is a complete record of all the financial transactions in a business, logged by bookkeepers using double-entry bookkeeping from the data recorded in the books of prime entry to each of the individual accounting ledgers.

What is a General Ledger?

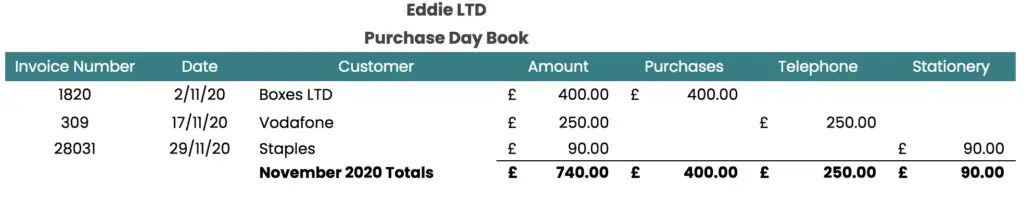

The general ledger is a report that contains all the individual ledgers, where transactions are grouped into similar categories. Let’s go back to the example of the purchase ledger below:

The information summarised is categorised into groups of a similar nature. The next step when it comes to using the information summarised is to transfer it to the general ledger putting the totals into individual accounts that match the purchase day book. In example above that’s purchases, telephone and stationery.

Every business is different, so each one will have different ledgers in the general ledger. Examples of individual ledgers are:

- Sales

- Wages

- Rent

- Rates

- Travel

- Marketing

- Bank charges

- Stock

- Fixed assets

Where a computerised system is used, the general ledger is often referred to as the chart of accounts. And instead of transferring totals like in the example above, every transaction in the business will be shown within the ledger. The ledgers are updated in real-time, every time a transactions is entered. But in manual accounting systems, the summary totals are transferred on a less regular basis for example, by week or by month.

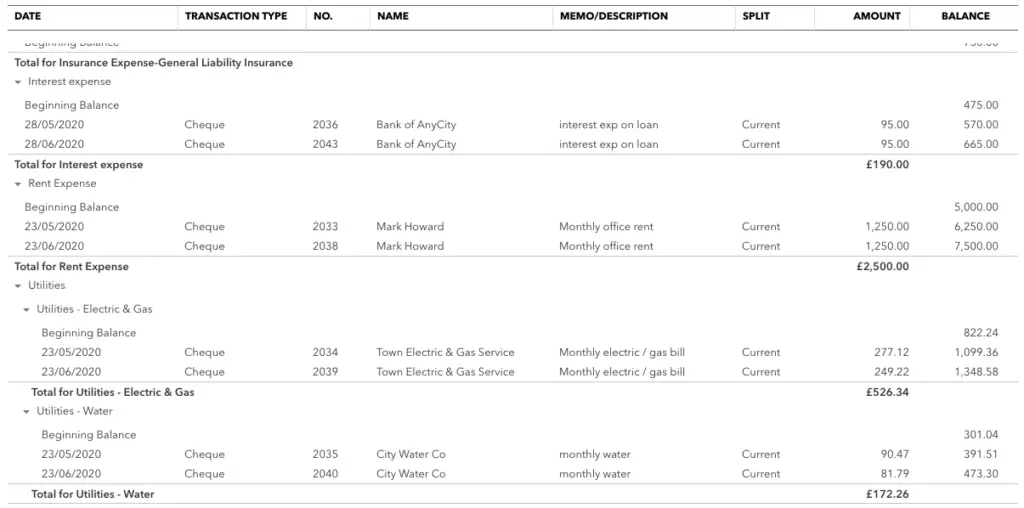

An Example of the General Ledger (Computerised)

Here is an example of a general ledger from the Quickbooks Demo Data. It shows the individual ledger accounts for Interest, Rent and Utilities, as well as the individual transactions that make up the closing balance.

Each entry is organised by date, accompanied with the following information:

- Date

- Transaction Type

- Transaction Number

- Name

- Details

- Amount

An Example of the General Ledger (Manual Accounting)

Computerised accounting systems automatically take care of double-entry bookkeeping and updating of the general ledger. However, in manual systems, information needs to be transferred from the books of prime entry, using double-entry bookkeeping.

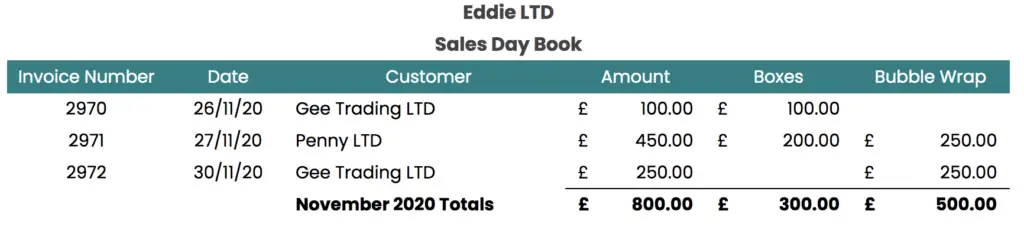

Let’s take this example of the sales day book:

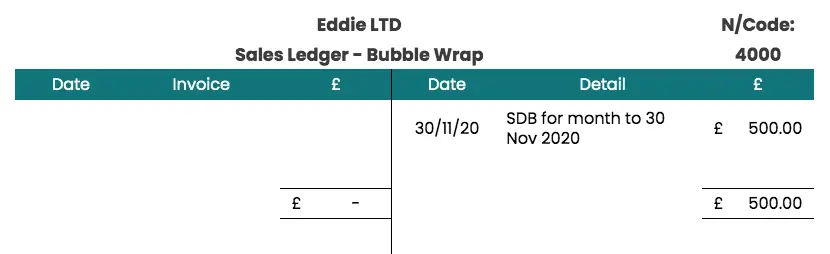

To transfer total sales for November 2020, the bookkeeper would create a t-account for sales and note the transactions as follows:

In this example the information from the sales day book has been transferred into two general ledger accounts to break out the different types of sales. Some businesses may choose to have only one account for sales in their nominal ledger – it depends on the business and the level of information they required.

The 5 sections of the General Ledger

It is customary to group the individuals ledgers into five sections within the general ledger:

- Income

- Expenses

- Assets

- Liabilities

- Equity

This doesn’t just keep the ledger tidy, it also helps when summarising the information at trial balance stage so that the financial statements can be prepared.

General Ledger vs. General Journal

The general journal is a manual accounting adjustment made to record transactions that are not included in the books of prime entry. The most common examples are depreciation and the accrual for corporation tax at year-end.

General Ledger vs. Trial Balance

The general ledger is a record of all the individual transactions, grouped by category. Whereas the trial balance is an extraction of all the closing balances on each of the individual ledgers.

General Ledger vs. Balance Sheet

A balance sheet is a financial statement, prepared for underlying financial information contained in the general ledger. The balance sheet is usually produced once the trial balance has been prepared, checked and adjustments made by way of journal entries.