Subsidiary ledgers form part of the accounting process when help is needed to keep track of financial information that isn’t recorded in the books of prime entry.

In this guide, you’ll find out more about the subsidiary ledgers, the common types used and how they fit into the accounting process.

What is a Subsidiary Ledger in Accounting?

In certain situations, there is a need for additional information to be recorded that supports the transactions being logged in the books of prime entry and the general ledger. They contain information that helps track numbers in a business or offers additional details to help understand more about where numbers have come from and what they mean.

What are the Main Types of Subsidiary Ledgers?

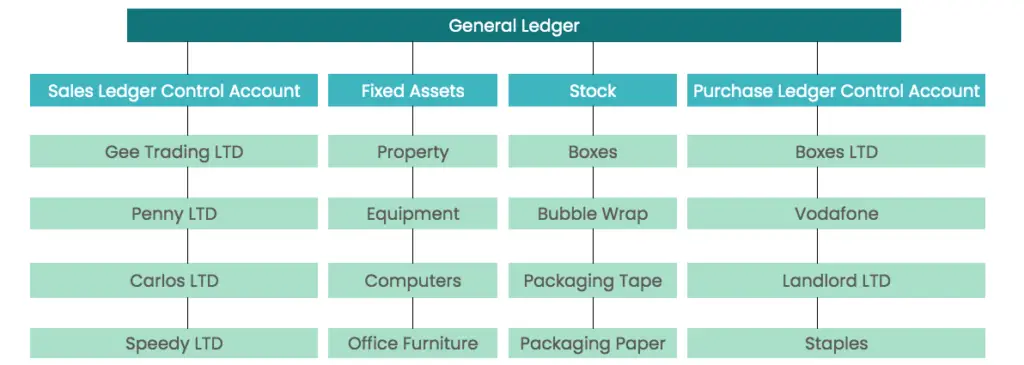

There are 4 main types of subsidiary ledgers in accounting:

- Sales (accounts receivable) ledger

- Fixed assets ledger

- Stock (inventory) ledger

- Purchases (accounts payable) ledger

Sales (Accounts Receivable) Ledger

The accounts receivable ledger is made up of individual accounts for each credit customer a business sells to. Within each account, credit invoices sent to a customer and the payments they make are recorded so the business knows exactly which customers owe money and can be chased correctly. The individual accounts are then added together periodically and compared to the sales ledger control account, carrying out what is known as the sales ledger reconciliation.

Fixed Assets Ledger

The fixed asset ledger is a list of assets, by type, owed by a business. Usually, the date of purchase, price and details are noted along with the depreciation rate being applied.

Stock (Inventory) Ledger

The stock ledger is a count of stock held by a business, by type of stock. It provide detail to the stock figure in the accounts to break down exactly what stock is held and in what quantities.

Purchases (Accounts Payable) Ledger

Similar to the sales ledgers, the purchase ledger subsidiary account shows how much a business owes to its credit suppliers. Periodically, the purchase ledgers should be agreed to the purchase ledger control account by carrying out a purchase ledger reconciliation.

What are the Advantages of using Subsidiary Ledgers?

Subsidiary ledgers bring several advantages:

- They avoid the need for lots of detail in the general ledger but allow for information to be held;

- They hold valuable information about who owes money and needs to be chased up for payment;

- They can be used to help check the accuracy of the balances in the general ledger such as the sales ledger control and purchase ledger control thus ensuring the accuracy of financial accounts.

What is the Difference between General Ledger and Subsidiary Ledger?

The subsidiary ledgers are a subset of the general ledger and although the subsidiary ledgers contain valuable information that supports key accounts in the general ledger, the numbers included are not actually entered into the general ledger. For example, the individual customers’ sales ledgers are not entered into the general ledger, they are a breakdown of the closing balance in the sales ledger control account.

Control Account v. Subsidiary Account

A control account, such as the purchase ledger control account, is a summary of total payments and total credit invoices received by a business. The subsidiary account, which would be the purchase ledger is a breakdown of the individual suppliers who are owed money. Periodically, especially when it comes to a manual accounting system, the total of all the individual suppliers ledgers should be added together and the total compared to the purchase ledger control account.