A bank reconciliation is used to check that no errors have been made when writing up the cash book. The cash book is one of the books of prime entry which is used to make entries in the general ledger and ultimately produce the financial accounts. That means it is really important check are made to ensure no mistakes have been made at the bookkeeping level.

What Is Meant By Bank Reconciliation

A bank reconciliation is defined as a check for differences between the closing balance on the cash book and bank statement at a particular point in time. The cash book should be identical to the bank statement, but in reality, this is rarely the case because some payments and receipts sometimes leave the bank account without notification.

What is the Purpose of a Bank Reconciliation?

The purpose of a bank reconciliation is to identify any transactions that have been missed out on the cash book before the general ledger is updated.

The most common transactions that are missed in the cash book and identified as a result of preparing a bank reconciliation are bank charges and bank interest. These need to be incorporated otherwise costs, like bank charges, may be understated in the financial statements.

How to Do a Bank Reconciliation

Here are the steps you’ll need to take to do a bank reconciliation:

- Obtain the bank statement

- Find the cash book

- Choose your reconciliation date (the date you plan to compare the cash book and bank statement)

- Set up your bank reconciliation template (see below)

- Identify the differences

- Update the cash book, if necessary

Bank Reconciliation Example

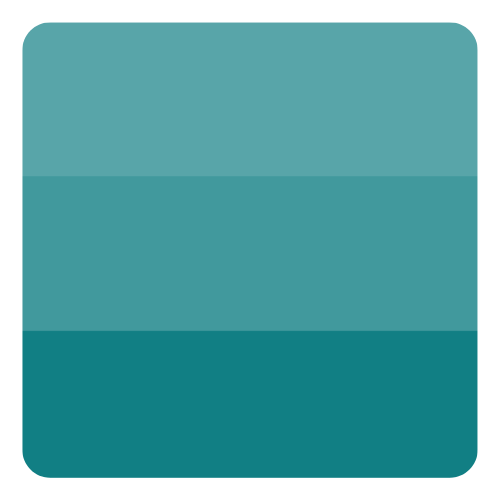

Eddie LTD is preparing the bank reconciliation dated 30 November 2020. The bank statement shows a balance of £1,615 but the cash book below shows a balance of £1,625.

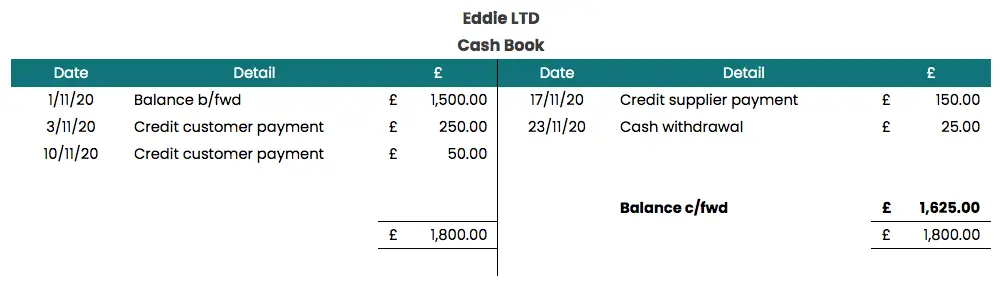

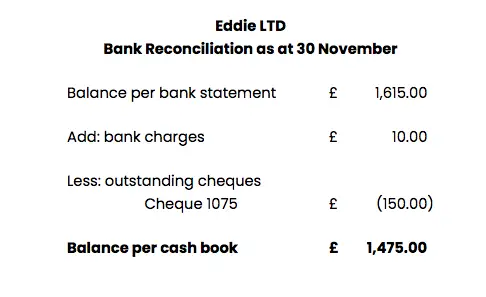

On checking the bank statements, it is discovered that bank charges left the account on 29 November for £10. The reconciliation would appear as follows:

The final step is to make an adjustment in the cash book for the missing bank charges of £10.

Adjusting Entries

The most common corrections and adjusting entries to the cash book required as a result of doing a bank reconciliation are:

- To include unrecorded transactions like bank charges, bank interest and dividends that commonly go through the bank without notification

- To fix errors in the cash book

- Timing Differences (see below)

Timing Differences on the Cash Book

In years gone by payments typically took place by cheque which took time to arrive because they were sent by post and then requiring depositing at a bank followed by more days to be processed by the bank. That meant the time between a someone writing a cheque and the money arriving in the recipients bank account, could be days or even weeks.

Nowadays, as cheques are being phased out, bank transfers generally happen on the same day meaning the balance you see on the bank statement is pretty accurate so a business knows how much it has to spend and what debts have been paid.

When cheques were used, timing differences arise which explained the difference between the cash book and bank statement because they may not have ‘cleared’ (in other words the money has not been sent or received because the cheque is being processed).

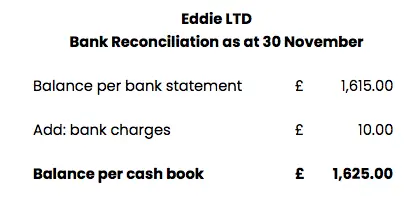

In our example above let’s suppose Eddie LTD has paid a supplier by cheque for £150 at the end of the month, but the supplier has yet to receive the cheque as it was sent out by post. The cash book now looks this:

Eddie LTD is preparing the bank reconciliation dated 30 November 2020. The bank statement shows a balance of £1,615 but the cash book below shows a balance of £1,475. Bank charges of £10 left the bank account but the cheque sent to the supplier has yet to clear. The bank reconciliation statement now looks like this:

No adjustment is required for cheque as this is purely a timing difference that will correct once the cheque clears (unless it has got lost in the post) but an adjusting entry is still required for the missing bank charges.

What is the Difference Between the Cash Book and Bank Reconciliation?

The cash book is one of the books of prime entry in accounting, where transactions are recorded. A bank reconciliation is a check of whether the items recorded in the cash book are correct or whether anything has been missed out.