A balance sheet in accounting, by name and by nature, must balance. This is achieved with the accounting equation, which is the rule that states the assets of a business must, at all times, equal its liabilities.

What is the Accounting Equation?

The formula for the accounting equation, in its simplest form, is made up of three elements:

ASSETS = LIABILITIES + CAPITAL

The equation is made up of three important parts:

- Assets – the things a business owns or is owed

- Liabilities – the things a business owes, debts and money that needs to be repaid

- Capital – the amounts owed to the owners for the business, whether that a sole proprietor, partners or shareholders.

These three elements form the basis of double-entry, the balance sheet and income and expenditure statement – which means the accounting equation is fundamental in accounting.

An Example of the Basic Accounting Equation for Sole Proprietors

To understand the basics of the accounting equation, we will work through an example of a sole trader business that has just begun trading.

Eddie has started a business to buy and sell cardboard boxes and packaging supplies. Eddie starts the business by putting £10,000 of his own money into the business bank account. Even though in legal terms, Eddie is liable for the business, in accounting terms it is a separate entity to him so it owes the money to Eddie.

To balance the accounting equation, every entry in the accounts must have an opposite balancing entry. So in the case of Eddie starting his business, using the equation, the first entry would look like this:

| Assets = | + Liabilities | + Capital |

|---|---|---|

| Cash £10,000 | £0 | Capital Invested £10,000 |

Next, Eddie purchases stock of 100 double-walled cardboard boxes ready for resale at a cost of £200. Eddie pays cash for the stock so by using the accounting equation, the business now looks like this from a financial perspective:

| Assets = | + Liabilities | + Capital |

|---|---|---|

| Cash £9,800 | £0 | Capital Invested £10,000 |

| Stock £200 |

The asset position of Eddie’s business has changed, but there is no change to the liability position. Capital is actually considered a liability because it is money owed back to the owners, although the terms of repayment are different from that of liabilities such as a bank loan or trade creditors.

Eddie now decides to have an e-commerce website to be built for his business. The web developer invoices for the cost of the website of £2,500 with 30 day payment terms. The assets and liabilities of the business have now become:

| Assets = | Liabilities | + Capital |

|---|---|---|

| Cash £9,800 | Web Developer £2,500 | Capital Invested £10,000 |

| Stock £200 | ||

| Website £2,500 |

Moving on, Eddie makes his first sale! He sells 50 double-walled cardboard boxes at a price of £4 per box. His profit is £100. The profit increases the capital available in the business so the accounting equation now looks like this:

| Assets = | Liabilities | Capital |

|---|---|---|

| Cash £9,900 | Web Developer £2,500 | Capital Invested £10,000 |

| Stock £200 | Retained profit £100 | |

| Website £2,500 |

The Treatment of Drawings in the Accounting Equation

When a sole proprietor withdraws money from their business it is called drawings in accounting and is not treated as an expense. The reason for this is that sole proprietors are taxed on all their earnings, regardless of how much they draw as salary.

Let’s suppose Eddie decided to draw a small amount of £50 from his business as a salary to compensate for the work he does in it. It would appear in the accounting equation as a deduction from retained profit like this:

| Assets = | Liabilities | + Capital |

|---|---|---|

| Cash £9,850 | Web Developer £2,500 | Capital Invested £10,000 |

| Stock £200 | Retained profit (£100-£50) £50 | |

| Website £2,500 |

The Treatment of Expenses in the Accounting Equation

Businesses have expenses that need to be paid for and, with the exception of the owners drawing a salary, these expenses affect how much profit is made. So when it comes to the accounting equation, expenses should be deducted from retained profit, with the adjustment for any cash paid or credit given in liabilities.

Following on from our example, Eddie prints some business cards at a cost of £25, payable up-front. Here’s the accounting equation:

| Assets = | Liabilities | + Capital |

|---|---|---|

| Cash £9,825 | Web Developer £2,500 | Capital Invested £10,000 |

| Stock £200 | Retained profit (£50- £25) £25 | |

| Website £2,500 |

The Expanded Accounting Equation for Sole Proprietors

The basic accounting equation is often expanded so that it is a little clearer what makes up each part. This is the expanded accounting equation for sole proprietors:

ASSETS = LIABILITIES + OWNERS CAPITAL – DRAWINGS + RETAINED PROFIT/LOSS (REVENUE -EXPENSES)

The Expanded Accounting Equation for a Corporation

The basic accounting equation, when expanded for an incorporated business, gives details relevant to that type of business structure, namely, share capital and dividends.

ASSETS = LIABILITIES + SHARE CAPITAL + RETAINED PROFIT/LOSS (REVENUE -EXPENSES) – DIVIDENDS

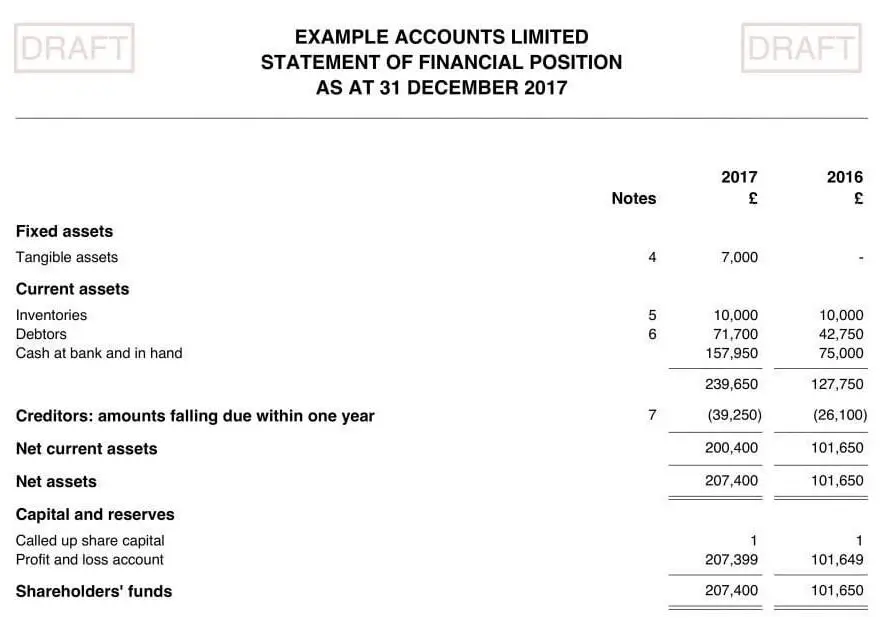

The Accounting Equation and the Balance Sheet

The accounting equation is also called the balance sheet equation because the parts that make it up are the same for each, although the equation is rearranged to:

ASSETS – LIABILITIES = SHARE CAPITAL + RETAINED PROFIT/LOSS (REVENUE -EXPENSES) – DIVIDENDS

The balance sheet is a laid out in three parts: assets, liabilities and business equity in the same order as the above equation.

Why Must the Accounting Equation Always Balance

The accounting equation must always balance because what happens in one account must affect another. For example, if a business buys an asset on credit, then assets increase but so do liabilities to reflect the payment owed to the supplier. If the accounting equation did not balance it would imply that one side of a transaction had been omitted and numbers in the account are incorrect.

There are transactions that may not affect the totals of the accounting equation because they don’t affect the other side of the equation. For example a business that pays cash for an asset will see no movement in it’s overall asset position.