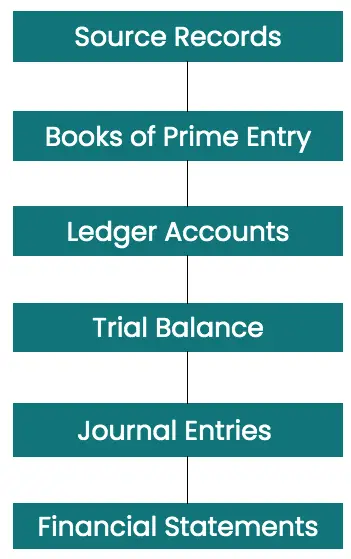

The accounting process (or accounting cycle as it is also known) is the series of steps bookkeepers and accountants take to gather, summarise and present the financial information of a business.

How Many Steps are there in the Accounting Process?

There are 6 steps in the accounting cycle that starts with gathering financial information, followed processing the data contained and organises them into categories so it can be presented. The steps, in sequence, are:

1. Source Records

The accounting process starts with gathering together source records, which are documents that are generated every time a business enters into a financial transaction such as receipts, invoices and bank statements. The first step is to gather all these records together because they provide foundations for everything that happens next.

2. Books of Prime Entry

Next, the information on the source records needs to be processed so essential financial information can be extracted and recorded in a way that financial statements can be prepared. The information is recorded in the books of prime entry, which lists out transactions of the business in different types of books including the sales days book (which is a list of sales invoices) or cash book (which is a record of all the transactions that have come in and out of the business bank account).

3. Ledger Accounts

The ledgers are a collection of accounts that summarises different information from the books of prime entry by category, for example, sales, different types of expenses and control accounts. The balance on ledger accounts either represents the total income or cost for a period of time. Or a balance at a particular date in time.

4. Trial Balance

A trial balance is a list of balances extracted from the ledger accounts. All the debits should equal the credits, meaning the net balance of all ledger accounts must be zero.

Where differences are found investigation is required to find where errors have arisen and to assess the general accurateness of the ledger accounts.

5. Journal Entries

Journal entries are an adjusting entry applied to improved to make corrections to the ledger account balances without going back to step 4, the books of prime entry. Examples include making accruals for expenses, deferring income or applying depreciation.

6. Financial Statements

Once the trial balance is correct, accounts can be prepared to summarise which is the final step in the accounting process. Financial statements are made up of:

- Profit and Loss Account (or income and expenditure statement);

- Balance Sheet

- Statement of Cash Flows

- Notes to the Financial Statements

Each part of the financial statements gives different information about the business, allowing the reader to understand a holistic picture about how the business has performed.