The petty cash book is one of the six books of prime entry in accounting. In some businesses, a small amount of cash is held on the premises to pay for things like milk or stationery. Sometimes, although increasingly rarely, customers may pay their invoices in cash, so this is included within petty cash.

The petty cash book is used to summarise the cash payments and receipts that have happened so the transactions are included in the financial statements and to keep an eye on where cash is going. It does not include transaction from the bank statements, those will be included in the cash book.

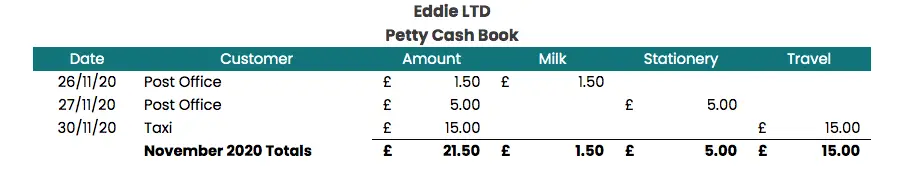

Example Petty Cash Book

The Imprest System

Some businesses chose to keep their petty cash balance at the same amount, so will top it up periodically so it’s always at that amount – this is what is known as the imprest system.

Here’s an example:

The boss at Eddie LTD wants to always have a float of £150 in the petty cash tin, so each week someone checks the cash in the tin and tops it up so that the balance is £150.

At the end of one particular week, spending was as per the example above and the balance in the petty cash tin is £128.50. That means a top of £21.50 is required (opening balance £150 minus closing balance £128.50).