An invoice is one of the most important source records and in this guide, you’ll leanr more about invoices, what is included on them and how they fit into the accounting process.

What is an Invoice?

An invoice forms part of the source records in accounting. It is a legal document sent out by a seller to a customer to request payment for goods or services it has supplied on credit.

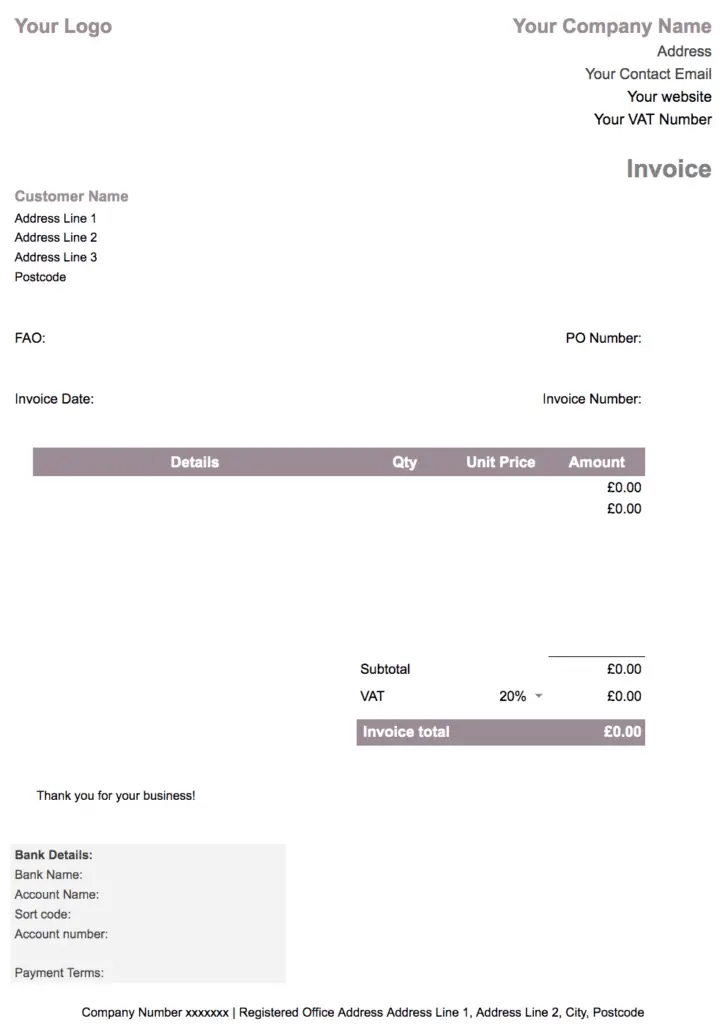

Although sales invoices can take any format or design a business chooses, there is certain information that businesses are legally required to include on depending on their legal and tax status:

- Name and address of the buyer and seller

- Date of sale

- Invoice number

- Description of the product or service sold

- Quantity and unit price

- Total amount payable

- Amount and rate of any sales taxes applied

- Details of discounts applied or early payment discounts available

- Credit terms and due date for payment

- Bank details

- Company registration numbers if available

A copy of the invoice will be kept on record to be accounted for as part of business turnover and often matched to purchase orders and goods despatch notes held as evidence of the sale. Another copy is also sent to the customer who will record it on the purchase day book in their accounts.

Example of an Invoice

Here is a sample invoice:

When are Invoices Raised?

Invoices are generally raised once goods or services are delivered, or prior to delivery if payment in advance is required to secure an order.

They are normally the final step in the sales order process, which although differs between businesses depending on their size and nature, looks like this:

- Customer requests a sales quote

- Customer accepts the quote and send a purchase order

- The seller raises a sales order and sends a copy to the buyer

- The seller prepares the order

- The seller dispatches the order and the buyer confirms delivery

- The seller raises a sales invoice

- Customer pays the sales invoice in accordance with the payment terms set out by the seller.

Invoice Numbering

Invoices are assigned a sequential number, this helps to keep track of invoices that have been raised as well as with financial reporting and identification.

What Happens if a Mistake is Made?

If a mistake is made on an invoice, for example, if an order is sent out incorrectly or the buyer raises a dispute then a credit note will be raised to correct the issue.